capital gains tax changes 2021 canada

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. Below is how the federal tax brackets break down for the 2021 tax year.

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

Feb 7 2022.

. The maximum pensionable earnings is. For now the inclusion rate is 50. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

In other words for every 100 of. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. Special to The Globe and Mail.

This means that only half of your capital. Whats new for 2021. Posted on January 7 2021 by Michael Smart.

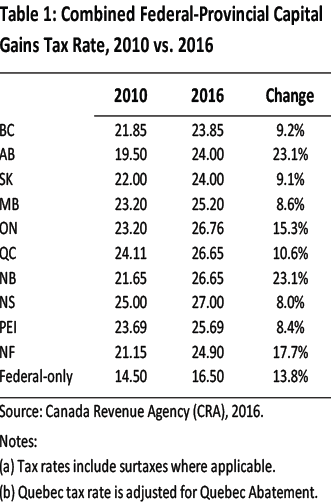

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

In our example you would have to include 1325 2650 x 50 in your income. The Senate of Canada is reviewing legislation which if passed would provide for greater flexibility and planning opportunities for tax-free intergenerational transfers of shares. The amount of tax youll pay.

The proposal would increase the maximum stated capital gain rate from 20 to 25. This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top. In Canada 50 of the value of any capital gains is taxable.

The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate. Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. Published January 12 2021 Updated February 9 2021.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. First deduct the Capital Gains tax-free allowance from your taxable gain. To address wealth inequality and to improve functioning of our tax.

Add this to your taxable. While it might seem like a tax the rich policy from Canadas left-leaning party the right-leaning Conservatives raised the capital gains inclusion rate to 6667 per cent from 50 per. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. For more information see What is the capital gains deduction limit. The effective date for this increase would be September 13 2021.

Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. How to prepare for a potential tax hike on capital gains.

The inclusion rate for personal. Im interested in 2021 changes in the capital gains tax and the dividend tax credit. Its time to increase taxes on capital gains.

As well understanding the typical effective date of changes relative to the Federal budget date.

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

Personal Income Taxes And The Capital Gains Tax Fraser Institute

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

/cloudfront-us-east-1.images.arcpublishing.com/tgam/K6BAZ2BJFVAHNLZ67LTPOFIEJ4)

Increasing Taxes On Capital Gains Would Be Stifling For Canadian Investors The Globe And Mail

Shlomi Steve Levy Entrevue Dans The Globe And Mail How Biden S Tax Proposals Could Affect U S Persons In Canada Levy Salis

2021 Capital Gains Tax Rates In Europe Tax Foundation

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Understanding Taxes And Your Investments

Understanding Capital Gains Tax In Canada

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

What You Need To Know About Capital Gains Tax

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)