are taxes cheaper in arizona than california

It is because it has a low tax rate has more facilities and has more benefits from the government. As of 2022 single taxpayers in California pay as high as 10 with the rates.

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Also you will find that the state sale tax in Arizona and California is 66 and 725 respectively.

. However it has lower taxes when compared to the other states in the US. Property tax per capita. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133.

Does Arizona have property tax. Arizona individual income tax rate is 454 while Californians need to pay 93. The federal income tax has seven tax rates for 2020.

Well how about property tax. Living in Arizona vs California Comparison. The taxes in Arizona are cheaper compared to the other states.

Arizona has the lowest registration fee. Arizona has four total income tax brackets with rates ranging from as low as 259 to as much as 450. Compare these to California where residents owe almost 5 of their income in sales and excise taxes and just 076 in real estate tax.

Are taxes cheaper in Arizona than California. State sale tax is also lower in Arizona being 660 in comparison with 725 in California. What percentage should I withhold for taxes.

Arizona individual income tax rate is 454 while Californians need to pay 93. Florida follows with a new vehicle registration fee of 225. CA has some of the highest taxes in the Nation personal income tax rates are roughly double of AZs and Gas taxes are higher also But you do get more benefits.

As this years tax-filing deadline April 18 comes closer its. Taxes in Phoenix Arizona are 77 cheaper than California City California. This simply means that lower brackets pay lower rates and higher brackets pay higher rates.

The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homes. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. The state income tax sales tax and property taxes are lower than that of California state.

Arizona is not a tax-free state. Tax Rates in both these states differ greatly. Is Arizona a tax-free state.

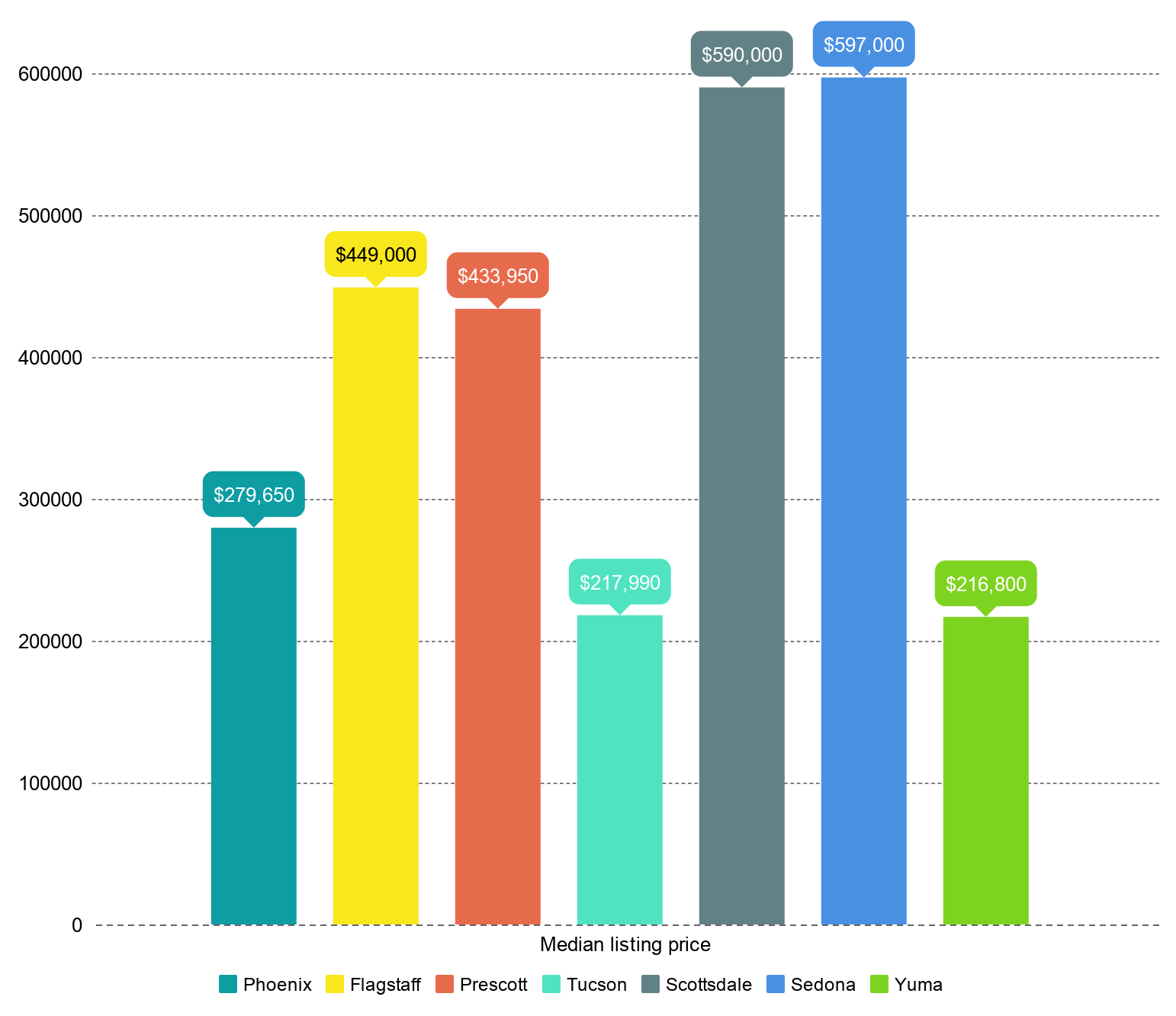

This relatively high tax could easily make selling and buying houses to be a daunting task for many people. Median home prices are also about 800000 which is easily the highest in the nation. State sale tax is also lower in Arizona being 660 in comparison with 725 in California.

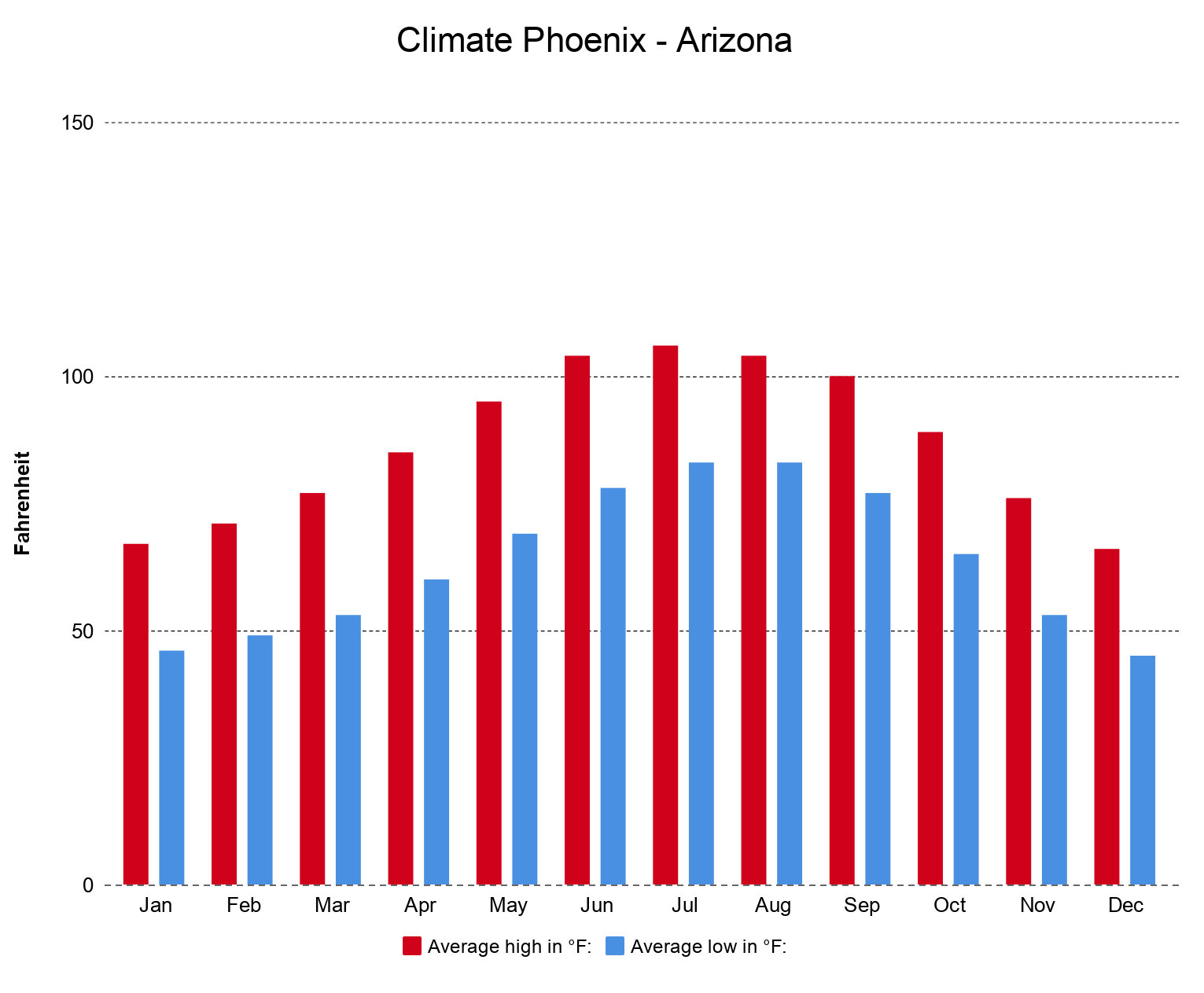

On average Californians will part with up to 93 in income tax which is higher than the 45 in Arizona. Between the tax relief and lower cost of living we are economically much better off than when we were in CA. In contrast almost everything such as housing groceries transportation utilities and healthcare are cheaper in Arizona.

Arizona is basically quite cheaper than California. Residents of the coastal state have to pay almost twice more of the state income tax. The prices vary in the different cities within the states.

Cost of Living Indexes. However the average rental price in Arizona is 1500 which is considerably lower than Californias average cost of 2200. This is a one-time fee and there are separate additional fees based on the vehicles weight.

Like Arizona California also has a progressive income tax. The tax burden in Arizona is small compared to that of other states because of its lower-than-average property taxes so the decline in home prices has hit Arizonas municipalities harder than those in many other states. Tax Rates in both these states differ greatly.

Arizona individual income tax rate is 454 while Californians need to pay 93. In this state the corporation is required to pay the gross receipts tax on each sale instead of a traditional income tax based on its earnings. Registration fees following the first fee are 1450-3250.

In December we moved form CA to AZ and have not looked back. 2 New Jersey and New York also implement this type of millionaires tax. 10 percent 12 percent 22 percent 24.

When comparing tax rates between both states the tax rates in California blow right through the roof. State sale tax is also lower in Arizona being 660 in comparison with 725 in California. Are taxes cheaper in Arizona.

In fact the cost of living is roughly 50 higher in California than in the rest of the US. From food to housing everything is quite organized and calculated according to the budget.

Living In California Vs Living In Arizona Youtube

Apache Gold Gravel Landscape Rock And Material Supply

Moving From California To Arizona Benefits Cost How To

State Income Tax Rates Highest Lowest 2021 Changes

Living In California Vs Living In Arizona Az Vs Ca Youtube

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

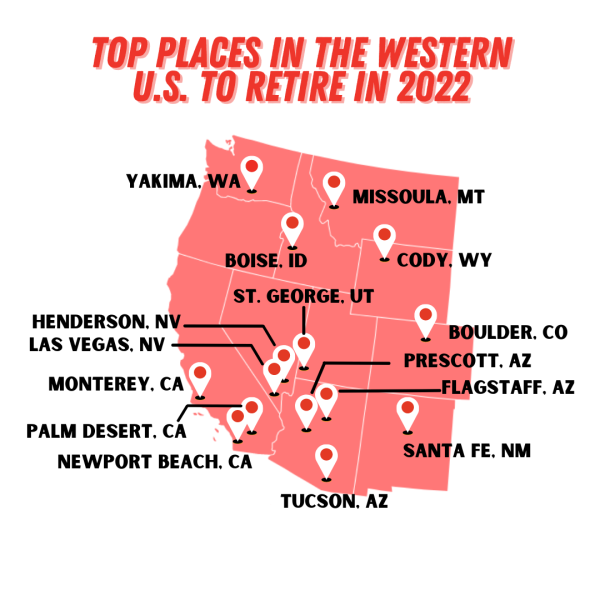

15 Best Places To Retire In The West 2022 Retirebetternow Com

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Land For Sale In California Land For Sale Mohave County Rural Land

Arizona Governor Sends Message To Californians Moving To Arizona Youtube

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Free Coupons For Airport Parking With Free Reservations Airportparking

Pin On Dream Oh The P L A C E S I Will Go

Az Big Media Where Does Arizona Rank In Cost Of Living Az Big Media

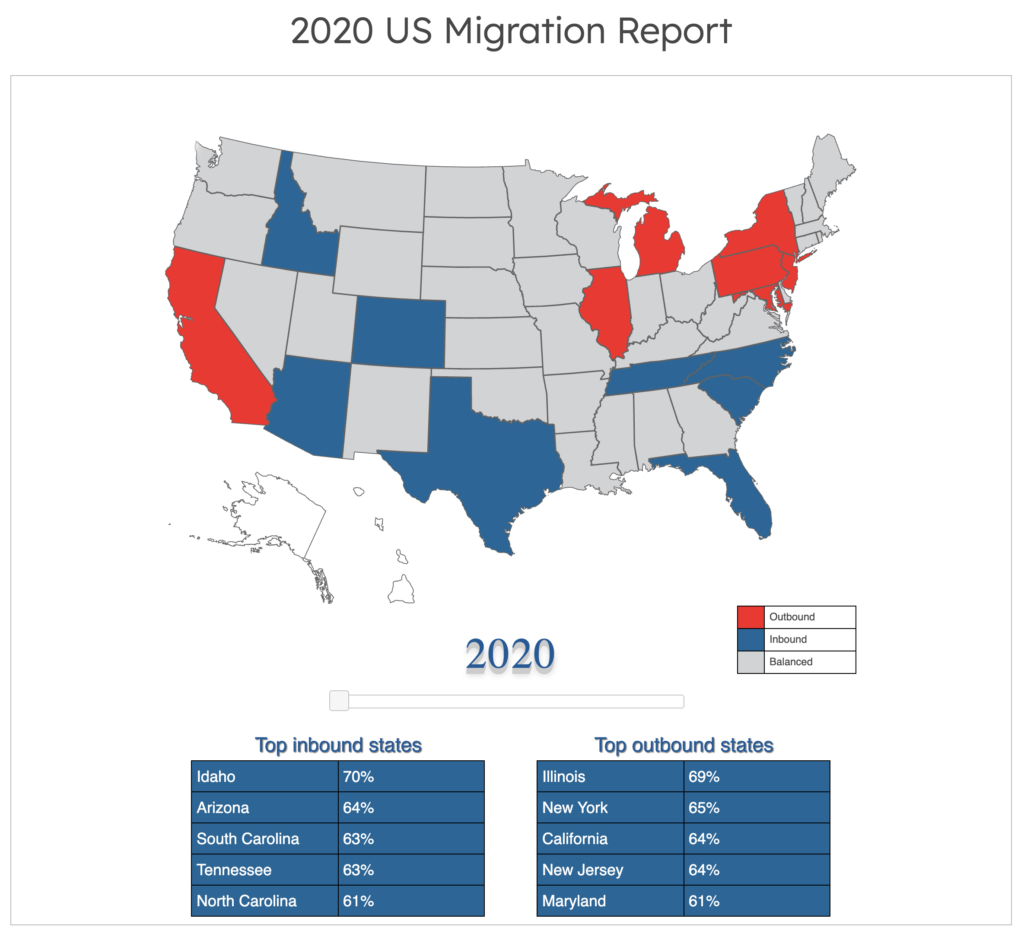

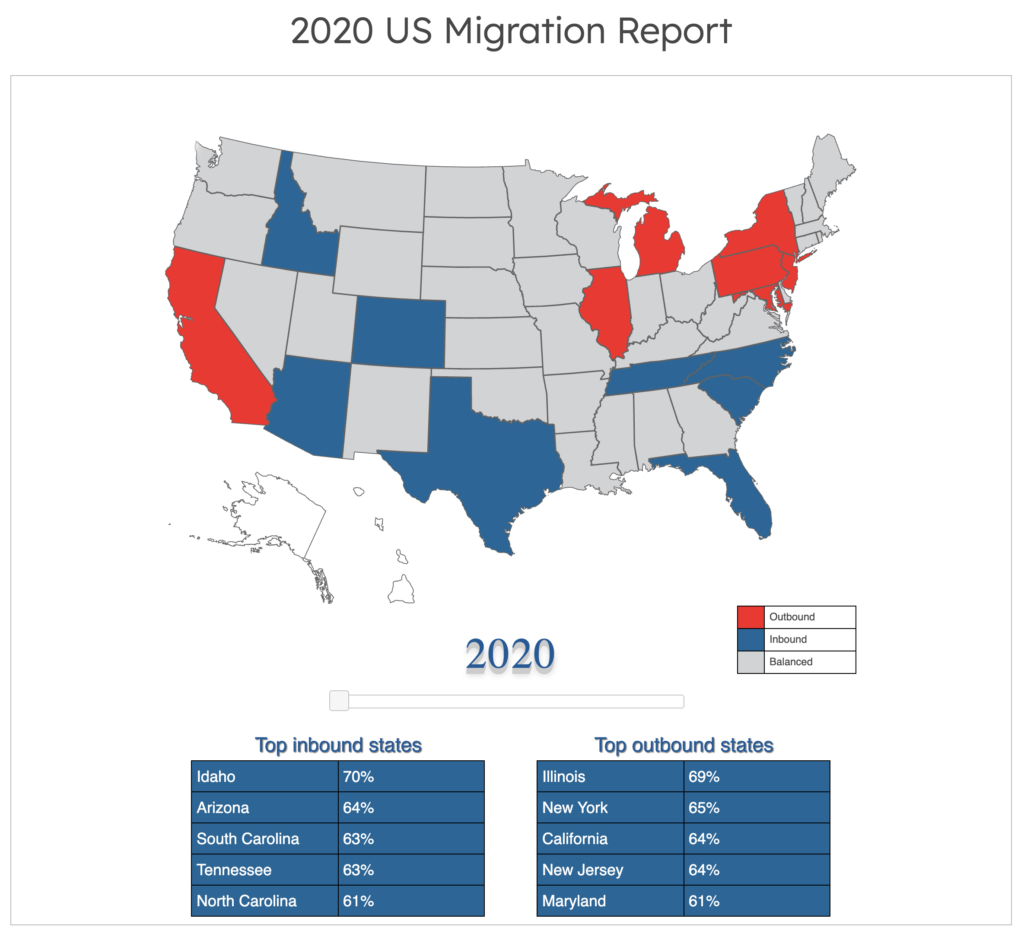

Az Big Media New Yorkers Californians Flee To Move To Arizona Az Big Media

State Corporate Income Tax Rates And Brackets Tax Foundation